- Fashioned

- Posts

- Urban Revivo: A New Kind of Chinese Fast Fashion Challenger

Urban Revivo: A New Kind of Chinese Fast Fashion Challenger

The Zara-like retailer ramps up a big global expansion as Forever 21 goes bankrupt a second time.

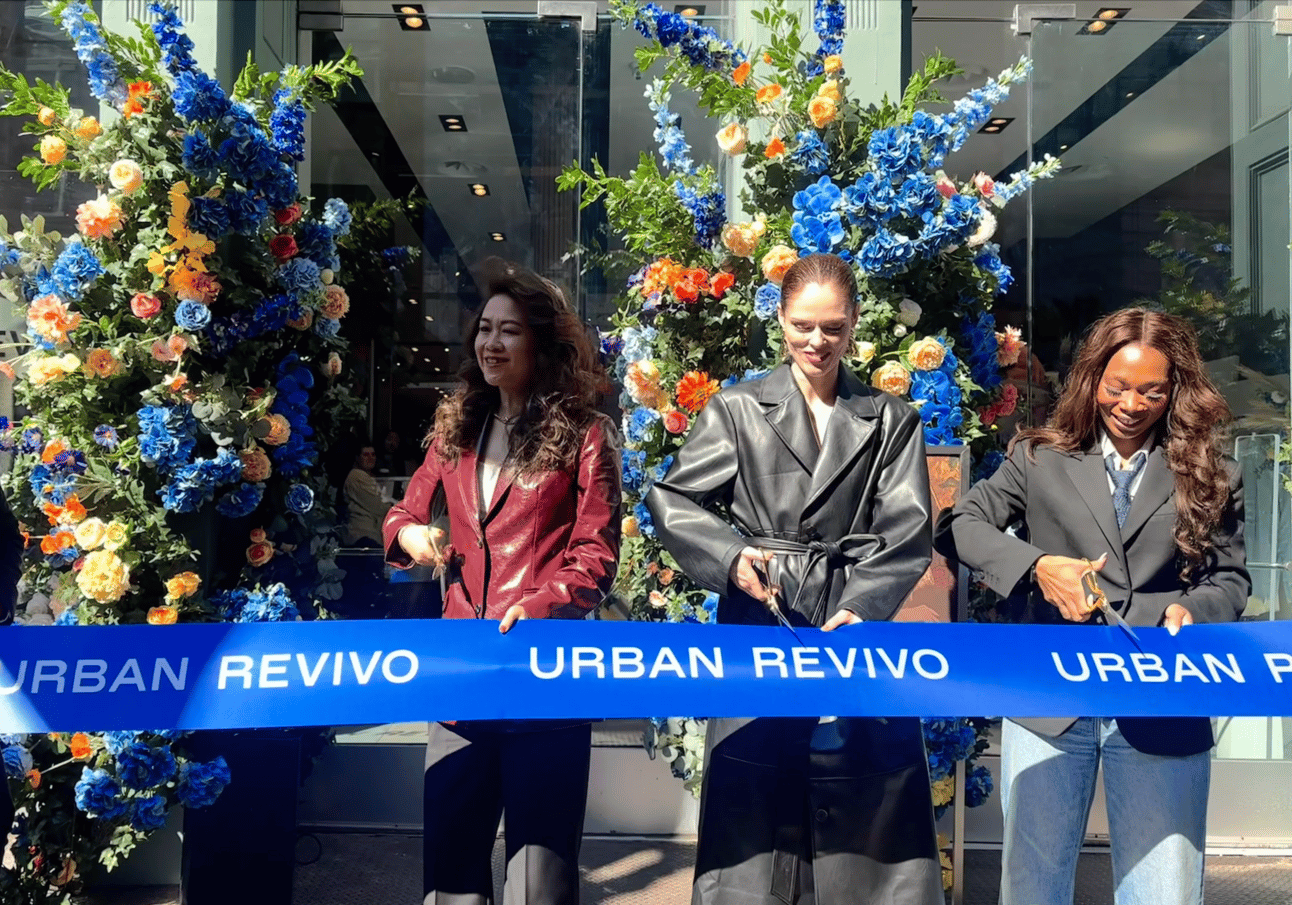

Model Coco Rocha helps Urban Revivo open their store in Soho, its first in America.

Luxury fashion gets so much attention lavished on it because of the big budgets and heavy concentration of celebrities but fast fashion realistically impacts people most and there’s plenty to parse there lately.

Urban Revivo, a Chinese equivalent of Zara, touched down in the US last week, opening its first American store in Soho and enlisting the model Coco Rocha for a ribbon-cutting. It’s part of a much wider global expansion—the company has been busy ramping up across Southeast Asia in the last year and is eyeing 20 new global locations including in Tokyo, London, Hong Kong, and Dubai in 2025. The year after, it is targeting around 100 non-China locations, hoping that eventually the US and Europe could account for a third or more of sales.

Just two weeks earlier, Forever 21 declared bankruptcy, the second time in six years. It will soon close 200 stores and potentially all 350 in its network if it doesn’t find a buyer. The news is not only telltale, it means conveniently for Urban Revivo that some nice shop locations closely suited for their target demographic will be vacant soon.

What went wrong? During its peak, Forever 21 operated over 500 stores in the US and 800 worldwide. The chain was hands down my favorite store through much of college. But with a name like Forever 21, the brand never really managed to attract older customers with more spending power, while Zara and Mango catered well to the working woman. My own life reflected this as well. As I entered the workforce, my wardrobe shifted to lean heavily on Zara.

H&M and Zara also invested a lot in becoming more eco-conscious and elevated doing high-low designer collaborations and premium capsules. But Forever 21 never got rid of its fast fashion with a capital F reputation. Which maybe would have been okay had ultra-fast fashion players like Fashion Nova, Shein, and Temu not entered the chat undercutting it in price and vastly outstripping it by number of styles. In 2023, Forever 21 announced a partnership with Shein that would include carrying some Shein products in its stores but it was too little, too late. Millennial high school favorites like Abercrombie & Fitch and Gap have made pretty significant comebacks but I don’t foresee Forever 21 getting resurrected.

Familiar Competition

Some background on Urban Revivo: Founded in 2006 by Leo Li, the Guangzhou-based company is indeed the Zara of China. While sometimes these “X of Y” analogies are off (seeing Alibaba get called the Amazon of China always really irked me because Alibaba does so much more), the first time I ever walked into a Urban Revivo store in Beijing, I had to do a double take because I thought for a second that I was in a Zara. Everything from the store design, campaigns, merchandising, and price point echoed the Spanish retailer.

While Urban Revivo will be going up against incumbents like Zara, Mango and H&M—no easy feat as their revenues dwarf Urban Revivo’s annual sales of around a billion USD—I’m more interested in seeing how they’ll fare against their online-only Chinese competitors like Shein or Temu. Urban Revivo, of course, has experience back in China where the competition is far fiercer. No single fast fashion brand commands more than a 2% market share and there are hundreds if not thousands of affordable Taobao labels.

But now is as good a time to go for it as any given China’s stagnant economy and Shein’s struggles. Shein’s profit dropped by more than a third in 2024, the FT reported, and its IPO in the UK is delayed to the second half of this year. It’s been challenged mostly by Temu, which has won over some of Shein’s suppliers. For a time, Shein tried to diversify its products to beyond fashion to compete with Temu’s “everything-store” offerings but the company did a quick reversal after margins deteriorated and focused back again on fashion.

Like Shein and Temu, so much of whether Urban Revivo can succeed comes down to the supply chain. On that front, Urban Revivo said it plans to manufacture half of its apparel overseas—producing trendier products closer to its global end-customers, while longer lead products can still be made in China. Production will start in Turkey this year to service Europe and it is looking for local options for the US, which will allow it to sidestep tariffs.

Product, Product, Product

It’s not easy to be a Chinese company intent on globalizing. It may not be a race for AI chips but the outward hostility between the US and China is enough to give any brand pause.

There’s also a lot of consumer bias. Chinese brands unfortunately have to be on the defensive about quality despite facts. I always find it funny when Americans say they won’t buy from Temu because it’s low quality but readily shop on Amazon, where over half of the vendors are Chinese. I frequently see the exact same SKUs on Amazon as Temu for twice the price—as if paying higher prices necessitates a positive impact in the supply chain as opposed to just passing on margin to the platform or merchant. I’m not saying that shoppers shouldn’t try to spend mindfully but just that it’s not really the virtuous behavior some people think it is.

Sure, there are weird croissant lamps on Temu and things that break easily but if you filter well, it yields plenty of gems. A little bit of fabric knowledge goes a long way.

Focusing on controllable factors however, Urban Revivo really needs to get the product design right. Asian customers are not only smaller and have longer torsos with shorter legs on average, the society is a lot more conservative. One of the reasons Forever 21 flopped so fast when it tried China was because their clothing range was too sexy. Deep V-necks and cropped shirts just don’t go over that well in the country. Although Uniqlo’s North America business is thriving now, getting the sizing and fit right was a major issue when it first arrived in the US and it took years for the Japanese retail giant to sort out.

Urban Revivo seems to understand this. It boasted at the Soho store opening that it had 600 designers working for them compared to 200 to 400 for their peers, and that includes a design center in London to serve the European and North American market.

“You might feel China’s a huge market, but if you have ambition, if you plan to go public, the market is not big enough,” Li told Bloomberg. “We believe there will be more globalized Chinese apparel brands in the next decade.”

That sounds about right to me.

What Else Is On My Mind

Prada may be buying Versace for 1.5 billion euros, a sizable discount from the 1.8 billion euros Capri Group paid for the maximalist fashion brand in 2018. Turning the brand around could take years and there’s rumors Donatella Versace is leaving (some serious key person risk). But the deal’s appeal? It could make Prada “less cyclical from a fashion point of view, since it would bring on board a brand with a very different profile," UBS analyst Susy Tibaldi said.

Those new US tariffs on Mexico and Canada are less likely to impact fashion, textiles, and shoes but as for China, well it covers everything.

Google Shopping launched “Vision Match”, a new AI tool and is adding other AR beauty functions.

Luxury brands have overdone the price hikes and now, rich people are disgusted with the state of fashion. “Bergdorf clients buy clothes so that they can go to fashion shows and brand dinners that exist to give them a place to wear this stuff but also to get them to buy even more clothes.”

Yes, it’s true. NYFW “somehow manages to become more bloated and more threadbare each season”.

“…[T]he week is otherwise gunked up by a gaggle of insipid brands that contribute little to the market and even less to the cultural conversation…One might think that natural selection would have weeded out these windbags by now, alas, it seems Darwinism doesn’t apply to fashion egoists grasping at relevance.”

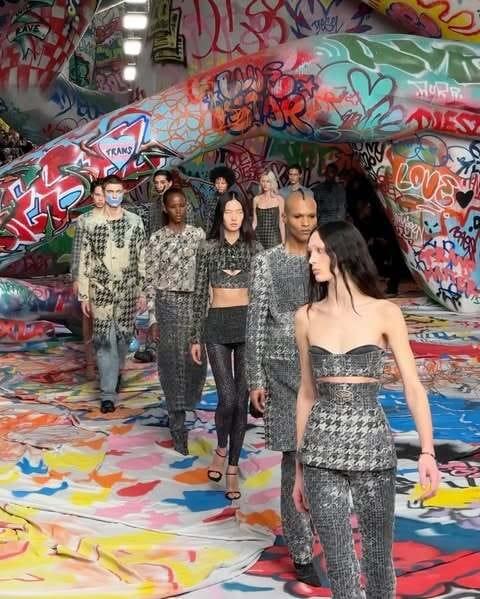

But here are recaps of the action from the London and Milan shows—like this vibey runway by Diesel, which amassed 7,000 international graffiti artists to design this set.

Paris-based department store Printemps arrived in the US and chose to open in Wall Street, an area that has yielded mixed results for retailers. Its ceo struck a very cautious tone in a conversation with WWD describing the market as “difficult” and “demanding” —and that they hold “reasonable expectations”.

I thought the Oscars red carpet was a complete snooze but on the topic of celebrity, here are the pop stars who are forecasted to dominate fashion this year.

Parker Posey, who stars in White Lotus Season 3, dances in a delightful Gap ad. The energy from the brand over the past year has just been incredible thanks to Zac Posen. (Did I really need four new pairs of horseshoe/barrel jeans? Yes but no but yes.) Anyway, stay tuned for next week when I’ll be writing about the TV series and what it means for Thai fashion and tourism.

Comments or questions? Drop me a note below. And if you know someone who would enjoy this newsletter or find it useful, go ahead and share it with them.

Reply